CPSC eFiling: The Times They Are a Changin’… on July 8, 2026

CPSC eFiling Is Going to be a Major Change for Your Operations

Non-Regulated Products: One big piece of good news is that the CPSC has backed away from a proposed requirement that importers of all consumer products files certificates in eFiling. Previously, CPSC proposed that every importer would have to check a box just to “disclaim” that a certificate of compliance is required. (Think about that for a moment. That would have meant that every shipment of ordinary things like paper towels, toilet paper, bath towels, etc. would have required a new extra step in the Customs process.) The costs and delays to the CPSC database and entry process would have been tremendous. This was a huge overreach by CPSC and the agency has thankfully backed away from it. The final rule only requires eFiling for products subject to mandatory safety standards..

Optional “Check the Box”: Even if your company’s products may not require eFiling, CPSC allows (and actively encourages) companies to optionally check a box stating that your product is not subject to a regulation. This is sort of like “proving a negative” to CPSC and the box is called a “Disclaim PGA Message Set”.

Why would you do this? CPSC has stated that, even though it is not required, accurately “disclaiming” the existence of a relevant regulation for a product by an importer will potentially lower the shipment’s “risk score”, thereby reducing the likelihood of having the shipment wrongly detained and investigated at the port.

Detentions and Seizures: Finally, CPSC staff have confirmed that – for now at least – failing to eFile a Certificates of Compliance will not be cause for immediate detention and/or seizure of the imported products. However, once the system gets moving in 2026, we do not expect that flexibility to last. For now, at least, CPSC is trying to avoid creating a massive traffic jam at U.S. ports.

Now, it’s time to move on to some of the practicalities and challenges.

Systems and Compliance

We all know that predictability is your friend in business. You have invested in having certain products in certain places at certain times. In fact, your retailer contracts require delivery of the products by a specified date. Delivering the products on time to meet your obligations requires having well-developed processes in place, even in the best of times.

Even if you have those well-functioning processes and controls in place now, eFiling will create complications.

Now is the time for your company to invest in improving upon your existing compliance program. Your company will need to upgrade, develop, or purchase software to help make sure that each shipment covered by the eFiling rule has up-to-date third-party testing documents and an up-to-date Certificate of Compliance associated with it. Your ERP systems will have to integrate with your compliance systems, which we – unlike the CPSC – understand is no easy process.

These investments will (hopefully) yield dividends in the future as your goods should sail past CPSC’s import inspection processes as compared to less prepared companies which will have a higher likelihood of having their goods delayed by costly and slow import detentions.

If this is the first you are hearing of eFiling and you import finished products into the United States, it’s time to put down whatever you are doing and pay attention.

The CPSC’s new eFiling rule is a major new requirement and is expected to impact tens of thousands of importers.

What is eFiling?

eFiling means that your company will now need to effectively “pre-file” your CPSC regulatory certificate of compliance (CPC/GCC) information for (i) all finished imported children’s products and (ii) other non-children’s products subject to mandatory safety regulations. This will need to happen before the products enter into the United States via U.S. Customs and Border Protection (CBP).

(This is a major change from the requirement that has been in place since 2009, which only called for this information to be provided to Customs or CPSC, upon demand, usually after entry has occurred.)

Pre-filing these documents is a huge change for your internal team’s and your customs broker’s import operation. In fact, the CPSC has developed an entirely new database to use to upload certificates before entry.

Your compliance and import processes will need a substantial investment to meet this requirement. This can be handled internally or with outside resources that customs brokers, laboratories, and independent companies may offer. Companies that aren’t ready will face new costs and potential shipment delays

Effective Date: The final rule set the implementation date for July 8, 2026 for almost all shipments. (Shipments to foreign trade zones have a compliance date in January 2027.)

Covered Products:

All Children’s Products listed here require a Children’s Product Certificate (CPC): Rules Requiring Third-Party Testing and a Children's Product Certificate | CPSC.gov

All the non-Children’s Product listed here require a General Certificate of Conformity (GCC): Rules Requiring a General Certificate of Conformity (GCC) - General Use/Non-Children's Products | CPSC.gov

Here is a list of HTS codes that CPSC has provided as a resource.

How Do You eFile?

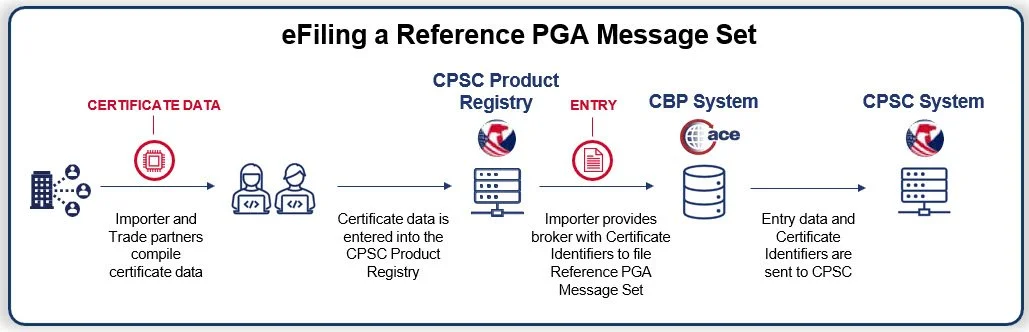

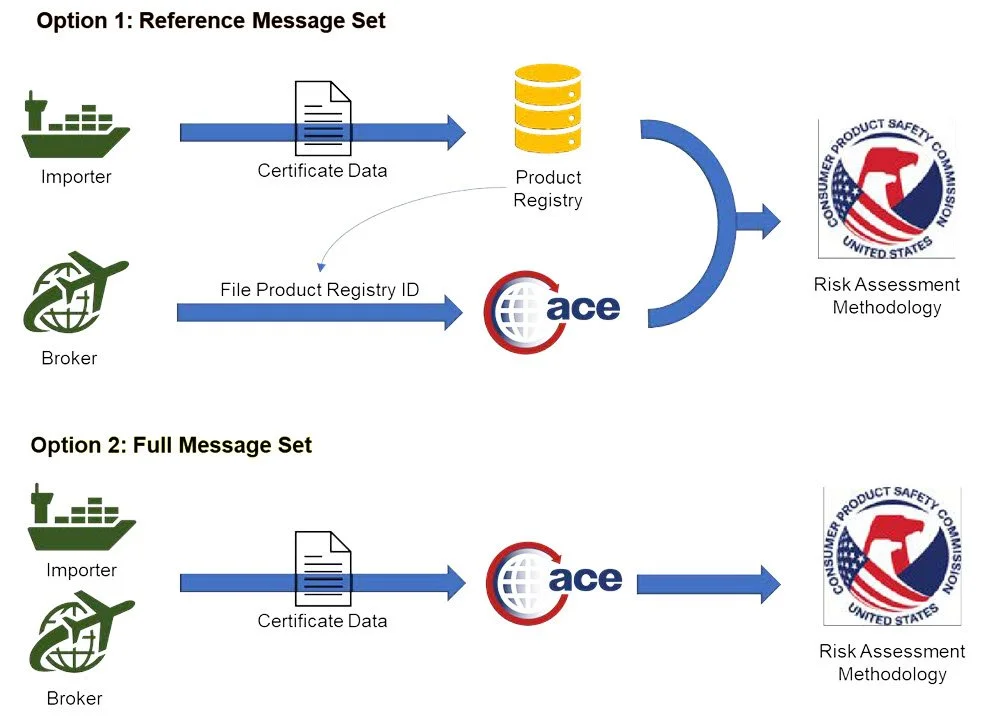

There are two choices (pictured below) on how a company can successfully eFile their shipments:

Option 1: You may register for the CPSC’s own Product Registry database.

Once registered, you may enter the 7 data elements from your CPC (or GCC) yourself.

Once that is complete, you will be provided with a new reference identifier number. That number must then be provided to your customs broker for inclusion with your entry documents. This is shown below by the CPSC and referred to as the “Certificate Identifiers.”

2. Option 2: If you work with a Customs Broker, you can provide them with the 7 data elements from your CPC (or GCC) as shown below. They will then enter this information directly into their system so that it meets the CPSC’s requirements. This is simple, although your broker may charge you for this work

Option 1 (Product Registry) allows you to reuse the same information (updating the test report, etc. annually) with less data entry,taking advantage of the drop-down options for regulations and laboratories built into the system. However, it requires the use of a new system into which you will need to enter shipment information in a timely and accurate basis. This will take a concerted effort for your systems to gather the required information – and to keep it current for new shipments. This overview article is too general to get into the specifics of each aspect of the Product Registry but there are ample resources provided by the CPSC, and we are always happy to answer additional questions.

The Product Registry is currently “open for business,” before the mandatory requirement goes into effect. Your company may sign up. This voluntary time period to use the system provides your company with an opportunity to register in advance, practice, and “pressure test” your systems to make sure that your goods are moving through smoothly and seamlessly when the requirement goes into effect.

Other Changes: “Attestations”

Your current certificates of compliance are changing. For the first time ever, Certificates of Compliance – whether they be a CPC or a GCC – will require a written “attestation” in which the company certifies the truth of the information being provided to the U.S. federal government. In the Customs or Product Registry system, this will be a “check the box” exercise. For paper and electronic certificates, the new attestation language below will need to be included by your company.

I hereby certify that the finished product(s) covered by this certificate comply with the rules, bans, standards, and regulations stated herein, and that the information in this certificate is true and accurate to the best of my knowledge, information, and belief. I understand and acknowledge that it is a United States federal crime to knowingly and willfully make any materially false, fictitious, or fraudulent statement, representation, or omission on this certificate.

Penalties for lying or misrepresenting to the federal government can be severe and this new attestation requirement further ups the ante to get things right the first time.

Other Changes: Manufacturer Name and Address

Your current certificates of compliance are changing in another important way.

CPSC is now requiring not just the location (city, state/province) of your foreign manufacturer but the actual (1) Manufacturer Name (2) Full Address and (3) Contact Information for the Manufacturer.

We understand that this is highly proprietary sourcing information. CPSC claims that it has carefully created controls in their Product Registry database to ensure that competitors will not have access to your supply chain information. That said, the various permissions that are available in the Product Registry must be carefully constructed to avoid sharing supply chain information inadvertently with your trade partners, whom you may elect to provide access to the database certificate information.

Know your products and their requirements.

If you only import non-regulated products, or products like adult apparel, that are regulated but subject to enforcement discretion regarding CPCs, not much will change for your company. Continue with your current sourcing practices and existing quality systems to ensure that your products are as safe and as high-quality as possible.

You may also wish to choose to (optionally) have your customs broker “disclaim” a CPC in your import shipments help speed your shipments through the Customs clearance process. We can help explain the logistics of how to do this .

CPSC Product Registry: Repeated Shipments:

If you import the same product again and again and that product is subject to mandatory regulations, then you should consider signing up for the new CPSC eFiling Product Registry database.

Customs Brokers: Keep It Simple

If you are in an industry (such as fashion, toys, etc.) where your products may change seasonally and you are not necessarily importing the same products over and over again, then you can continue to choose to provide the data needed for your CPC or GCC to your Customs Broker. Your broker can, in turn, enter and upload that information into their Custom’s Automated Customs Environment (ACE) System, where CPSC can access it.

While not quite as “seamless” as the CPSC Product Registry, this option may be a better fit for some companies.

* * *

While this update cannot possibly cover all of the changes this new rule will bring, we are ready to answer your more company-specific questions. From our own time working inside the agency, we are confident that there will certainly be implementation issues rolling out the system. When those occur, you will want to act quickly and confidently to contact the agency and resolve those.

We will continue providing updates on this issue and will be working with our clients to develop and implement the appropriate systems to make sure that your future imports are processed as predictably – and swiftly – as possible.